September 3, 2021

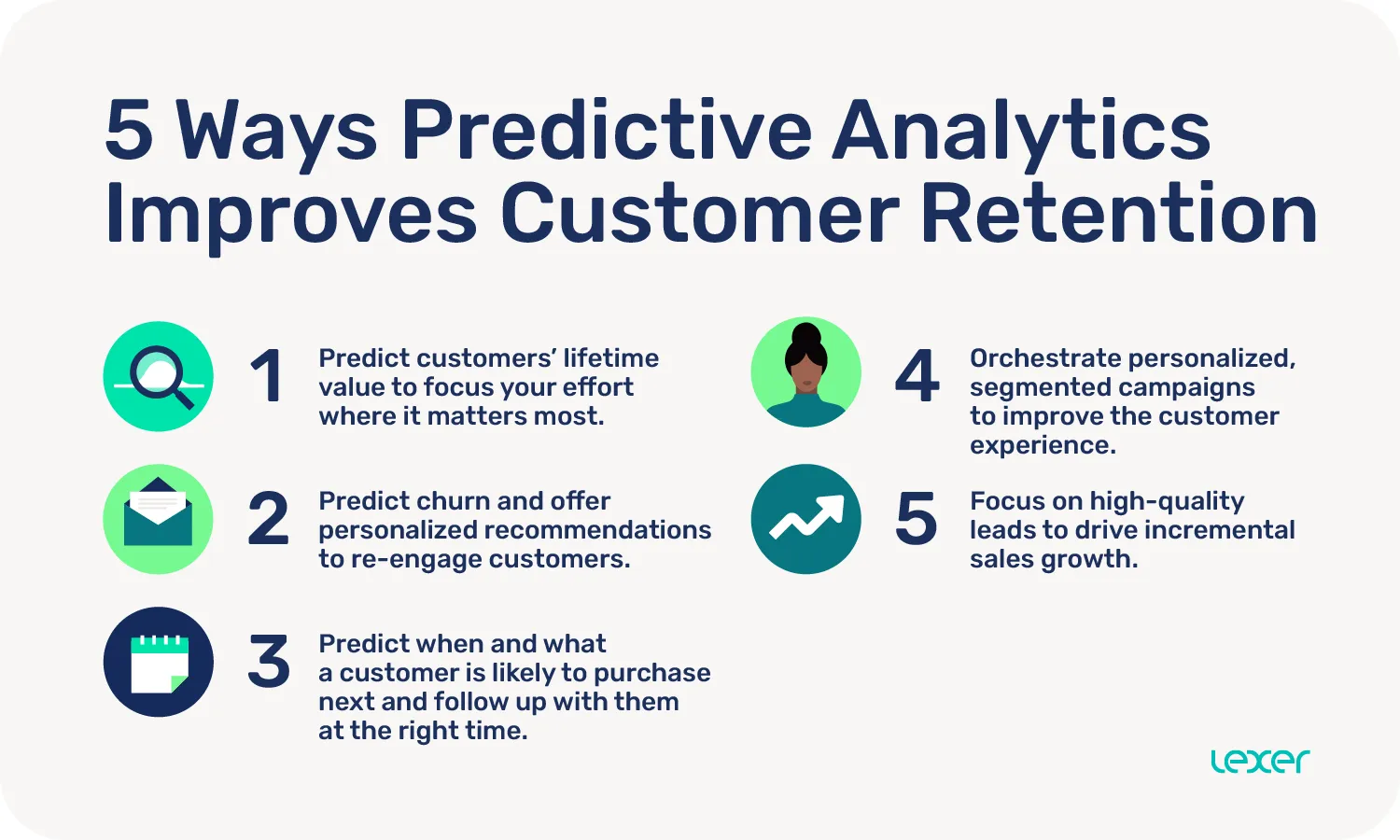

5 ways predictive analytics improves customer retention

In the hyper-competitive retail and ecommerce market, you need an airtight strategy to increase your customer retention rate and get ahead of the competition. Using customer churn prediction software such as a Customer Data Platform (CDP), you can predict and prevent churn before it happens. Here are 5 ways predictive analytics improves customer retention.

Research shows that teams that use customer and retail data analytics to make decisions have a 126% profit improvement over businesses that don't. If you’re not already using predictive analytics to predict churn and improve your retention rates, then you could be falling behind.

Read on for more details on how predictive analytics boosts customer retention.

5 ways predictive analytics improves customer retention

1. Predict customers’ lifetime value to focus your effort where it matters most.

With an extensive customer base and a lack of combined customer data, it can be difficult to understand which customers provide the most value to your brand. Some will only plan to make purchases during mega sales to get some discounts, and others will only make one purchase, while others will only buy from a specific category—but no matter the specific behaviors of your customers, most businesses find that only a small percentage of their customers make up the majority of their sales.

Using predictive analytics, you can predict the lifetime value of specific customer segments. This data can help you make adjustments in your marketing efforts and emphasize those who offer more value.

2. Predict churn and offer personalized recommendations to re-engage customers.

Customer churn prediction for the retail industry can be complicated because retail consumers tend to go through a “cool down” period before fully churning. During this cool-down period, it’s still possible to win those customers back with targeted outreach—but if you can’t predict churn ahead of time, you might wait too long to send this outreach, missing your final window for re-engagement.

With unified customer data and predictive analytics models to track early indicators of churn, you’ll be able to identify customers with a high likelihood of churn ahead of time and step in to retain these customers before they’re gone for good.

Customer data helps you track early indicators of customer churn and step in to retain them before they are gone. Although different businesses have varying indicators of churn, some of the most common include:

- Lack of email engagement.

- Service-related complaints.

- Negative product reviews.

- Irregular buying patterns.

- A decrease in overall spend.

After predicting customers’ likelihood of churn using these indicators, you can dig deeper into your customer data to determine their interests and shopping habits. These customer insights will help you personalize your re-engagement strategy to increase your chances of success.

3. Predict when and what a customer is likely to purchase next and follow up with them at the right time.

Predictive analysis can also help you estimate when a customer is likely to repurchase a specific item.

If a returning customer has purchased the same product twice or thrice, you can estimate the next time of making another order. If the duration is about four or five weeks, you can email the customer around this time and include some complimentary items that a customer is more likely to purchase. The reminder is a great way to increase customer retention and ensure that customers stay loyal to your brand.

For more information on how to use predictive analytics to ensure the right timing and messaging for your outreach, read “An upsell marketing strategy to convert the second sale.”

4. Orchestrate personalized, segmented campaigns to improve the customer experience.

Customers are different, so you need to treat them differently.

Predictive analysis provides all the essential details about your customers: Their relative lifetime value, the risk of churn, the products they’re most likely to buy next, and more. Once you gather all these details, you can segment your customers into different groups and see how each segment responds to your brand. You can then tailor your strategies to fit each of the specific groups and adopt different approaches to boost customer retention metrics.

For instance, you can segment customers based on the likelihood of making a repurchase within 30 days. You can also have another group based on the amount spent on specific categories or services. With all these groups, you can develop different marketing strategies to suit each category.

Predictive analytics enables you to anticipate and measure how each group will respond to your promotional efforts. You can figure out the frequency and value of the purchase of different segments. By understanding how each group responds, you can offer better, data-led customer experiences at every lifecycle stage.

5. Focus on high-quality leads to drive incremental sales growth.

If you have access to your existing customers' data and can measure and predict the lifetime value of different customer segments, you can create lookalike audiences of these segments and focus on higher-quality audiences for prospecting. You can use predictive analysis to compare different characteristics and features of your customers against those you presume to be potential customers.

If you see that prospects have similar characteristics to your high-value customers, such as lifetime spend, demographics, Experian Mosaic group, and more, there is a higher chance they would buy your products. Funnel more resources into targeting this group to increase your likelihood of driving sales and creating valuable, long-term customers.

Key takeaways

Predictive analytics has made a drastic change in the way digital marketing works. You can now access data to help you enhance your campaign strategies. You will know the products that your customers prefer and how to improve your customer experiences. This way, you will have a higher customer retention rate and increase your brand loyalty.

CDPs like Lexer offer AI-powered predictive analytics, third-party data enrichment, and targeted customer surveys to help you gain the most complete and accurate picture of your customers. This way, you can predict how they’ll behave and adjust your engagement strategies for the highest chance of success.

Master your customer data with Lexer to help you drive your sales growth and personalize customer experiences in retail. Book a demo to see how Lexer's powerful CDP and marketing, sales, and service tools can help you improve retention rates and grow lifetime value.

Interested in learning more about how Lexer can help you improve customer engagement and maximize results? Book a demo with one of our retail experts today.

Speak with our retail experts